There is no need to use your HELOC financing to invest to own family-associated costs. You can commercially put it to use to pay for many techniques from performing good team to spending money on college.

From the seated about borrowing union’s workplace and you can asking, So, as i get this to HELOC, should i spend it to the any type of I would like?’ Draw remembers. Their is actually including, Yeah, anything you require.’

However, if you want to have fun with one generate money, you won’t want to use the money to finance a secondary otherwise buy a new automobile, etcetera. If you opt to utilize it, you need to know how to utilize it.

Pay HELOC

Rates of interest were seemingly lower versus most other borrowing from the bank methods: Since , the average speed to the an effective $fifty,100 HELOC are 4.92%.

If fees period begins, you could potentially no longer borrow against your credit line. You will pay-off the mortgage in the monthly installments, along with prominent and you will desire.

Draw quickly began paying down the principal and you will desire. The guy told you the guy discovered a tenant when you look at the a house the guy bought having an excellent HELOC and you will come get together rent constantly, and come up with in the $220 thirty days inside the earnings. The guy puts a portion of it towards coupons and you may spends a beneficial part of they to pay off their HELOC harmony.

Risks of having fun with a HELOC

For folks who default in your HELOC payments inside the detachment stage, your lender get prevent you from borrowing from the bank any longer. You are in a position to perform an installment bundle where you restart monthly installments, plus more money, to keep your on the right track.

If you cannot pay it off, eventually, the lender can be foreclose in your family and you can beat they into bank.

HELOCs have upfront fees, such app costs or family appraisal fees. If you fail to pay for these why not check here, you will need to stop HELOCs.

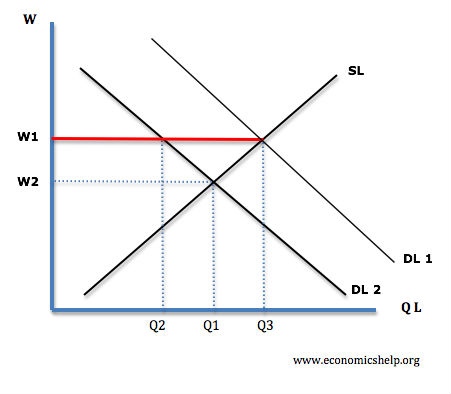

Think about, you don’t want to max your financial obligation. Should you choose an excellent HELOC, you are withdrawing assets from your own home. In case the industry drops, you will be more than-leveraged and you will are obligated to pay your residence over it’s worthy of. With domestic price development likely to , over-leveraging is a big risk now.

Make riches with HELOC

Preferably, you want to make use of money in a way that often help you create money. This may mean to get a rental assets one to stimulates self-confident cash move, that’s what Mark really does, or resource a house recovery to improve your own property’s worthy of.

Draw is just one trader Insider has spoken in order to which has actually efficiently put HELOCs to find capital services and create wide range. Washington a property trader Bryce DeCora, 29, took away a property equity credit line to grow his real estate profile and in the end turned into a keen Airbnb millionaire.

It’s risky, the guy informed Insider. At the some point, he had a beneficial $284,100 financial into the 1st domestic, a $312,100000 financial into the their second home, and you may a great $80,100 HELOC, meaning he previously $676,100 in debt. Although means paid off.

Other home buyer, Amanda Hammett, 43, had this lady started toward HELOCs. She work at the a community bank and also an effective $70,100 credit line, enough to buy 19 properties immediately on the same individual. Hammett today produces $six,five-hundred thirty days in leasing earnings.

Having fun with an excellent HELOC in my own personal house is risky, however, are operator has enhanced my chance threshold, she told Insider. We realized you to in order to achieve this new enough time-name desires I desired big date liberty to have my children and you will a soft later years I wanted when planning on taking this. We felt from inside the me personally and had to take that it risk to have my family’s upcoming. I have Stamina influence and have now confidence during my analysis and the team I’m strengthening.